Ownership

The Company is owned by two shareholders, to wit, Corporación de Fomento de la Producción (CORFO), the majority shareholder, and the Chilean State, represented by the Ministry of Finance. Metro does not have any joint action agreements.

Regarding capital increases, at the Special Shareholders’ Meeting held on December 29th, the following was agreed:

- To increase subscribed and paid capital through the capitalization of fiscal contributions in the amount of M$185,140,328, par value, by issuing 5,985,784,934 series A shares to be subscribed and paid by the State and Corfo on a prorated basis according to their interests and share in the company.

A Series shares correspond to the initial capital and capital increases subscribed and paid by the Chilean State and the Corporación de Fomento de la Producción, and they shall not be transferred. B Series shares correspond to capital increases and may be held by other shareholders.

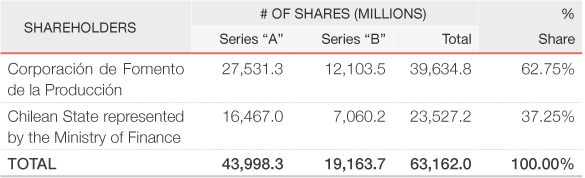

As of December 31st, 2015, the company’s capital stock consisted of a total of 43,998,312,563 Series A and 19,163,677,063 Series B, no-par value, registered shares, 39,634,775,932 of which are held by Corporación de Fomento de la Producción and 23,527,213,694 are held by the Chilean State.

As of December 31st, 2014, the company’s capital stock consisted of a total of 38,012,527,629 Series A and 19,163,677,063 Series B, no-par value, registered shares, 35,878,695,886 of which are held by Corporación de Fomento de la Producción and 21,297,508,806 are held by the Chilean State.

As of December 31st, 2015, shareholders’ company ownership was broken down as follows: